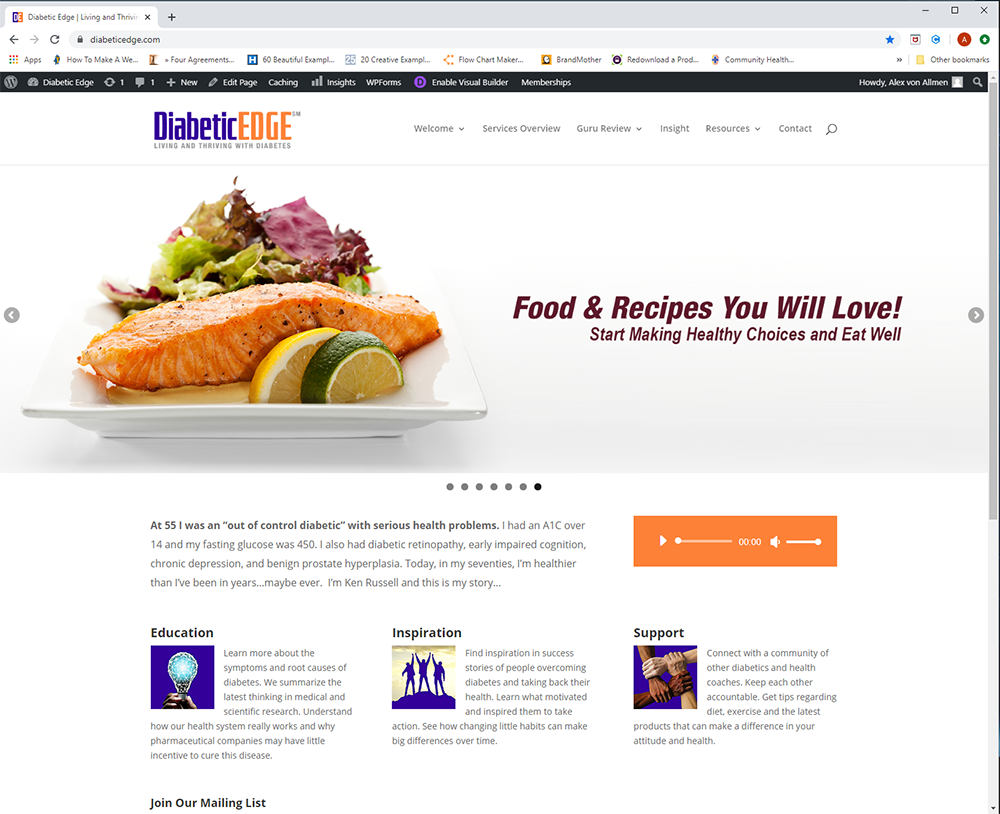

Diabetic Edge is a 501c3 non-profit which serves the diabetic community with education, inspiration and support. We discovered that there are over 30 million diagnose diabetics in the US and millions more who are pre-diabetic. Even though there is already an established player ( American Diabetes Association) We felt that the individual with Diabetes was being under-served.

Non-Profits Powered by Google Grants

Bring your passion to the world!

The Google Grant program creates an amazing opportunity to enhance the world by creating a new nonprofit company (501c3) or growing an existing one. Adword grants are up to $10k per month and can be used to generate worldwide awareness for your cause, reach under-served communities and find benefactor team members who resonate with your mission.

Identify Problem

We work with you to identify an under-served problem that is worthy of your time, energy and passion. We use search engine keyword tools to understand the awareness of the issue and potential to drive people to your internet site.

Build a Brand

Help you create a brand identity (logo) and find a domain name that positions you well in your chosen market. We create a total identity that your audience will recall.

Create a Website and start Curating Content

Create a website that serves as the foundation to educate, inspire and support members of the community you serve. The site is smartphone friendly. We add advanced plug-ins such as email capture and subscription membership software.

Become a Nonprofit

In order to receive Google grants and tax-exemption you will need to create a non-profit. Steps include:

- Recruit a team of directors and talented contractors

- Create mission statement, bylaws and corporate documents

- Incorporate at the Secretary of State ( in California that is $35)

- Apply for Federal 501c3 tax exempt status with 1023EZ (3-12 months)

Apply for Google Grant

One you are approved as a 501c3. We guide you through the Google grants application process. Getting a Google grant is a major milestone in the process.

Build and Refine a Sustainable “Business” Model

Our core service is helping you develop and refine a sustainable business model for your non-profit organization. Much of this is made possible by Google providing a sustained lead flow. We help you create digital information products, subscription memberships and donation campaigns that optimize your organization’s revenue and impact.

Make a Dent in the Universe

Our intention is to help you create a non-profit mission that brings awareness to and help solve world-class problems. As Alfred Nobel discovered, a nonprofit could be the legacy for which you are most remembered.

Important Notes:

We serve a very select group of conscious social entrepreneurs who want to make a “dent in the universe”. They want to bring awareness to and solve big “world class” problems. In some cases there might already be a well established non-profit serving the same community but doing so ineffectively.

Google grants are only available to 501c3 organizations and excludes trade associations, religious organizations and other worthy non-profits. The application and approval process is estimated to be within 30 days provided you have all appropriate documents.

A letter of tax-exemption from the IRS is a requirement of the Google Grants application. The IRS essentially segments their application process into streamlined (1023EZ at 2.5 pages) and involved (1023 at 40 plus pages). Essentially the IRS sees the streamlined process for “mom and pop” non-profits like neighborhood cat shelters and the 1023 form for corporate nonprofits. There is no real category for start-ups.

Director compensation is “red flagged” out the door to 1023EZ applicants but is a definite possibility for non-profits that meet certain milestones ( generally exceed $200K per year in sales). Executives are appointed by a board of directors and can receive viable compensation provided it follows certain revenue guidelines ( there are a number of resources available)

BrandMother fees are 10 percent of gross revenue receipts.