Opportunities in the Clouds

I believe that Software as a Service (SaaS) is one of the biggest opportunities of our time. Today there are over 15,000 SaaS businesses worldwide and they include giants like Salesforce.com, Indeed and ZenDesk. Amazon Web Services (AWS) has made going to market both affordable and easy. There are still a number of undiscovered niche opportunities and BrandMother has its radar out.

I view SaaS as a capitalization model allowing the publisher to better capture value they have delivered to their customers. In the past, a software company might sell a software disk for several hundred dollars. Customers had to overcome fear and concern regarding whether the software would work for them. Free trials and pay as you go models have greatly reduced this risk (barrier to entry) and have facilitated capturing ongoing value.

Salesforce.com, founded in 1999, now has $26 Billion in sales and a valuation of $215 Billion. Incidentally, I met the father of CRM in early 2000. Michael McCafferty would sell his software business for just over $6 million and buy a Ferrari. Who would have guessed CRM would become so big? Michael sold TeleMagic for about $200 per user. Today Salesforce offers its service for $75 to $300 per user…per month!

Many large software companies such as Adobe, Intuit (Quickbooks) and Microsoft have moved to subscription models. Net streaming consumer services such as Netflix, Amazon Prime and DisneyPlus are essentially subscription services as well.

Recurring subscription revenue is the holy grail for business. Look at utility, cable and insurance companies. These businesses are stable by nature and typically resistant to seasonality and business cycles. I used to think these kinds of businesses were boring…no longer!

There are several key metrics we look at:

- New subscribers per month

- Average Revenue per Subscriber

- Average Cost of Adding a new subscriber

- value Delivery Costs or Cost of Goods Sold

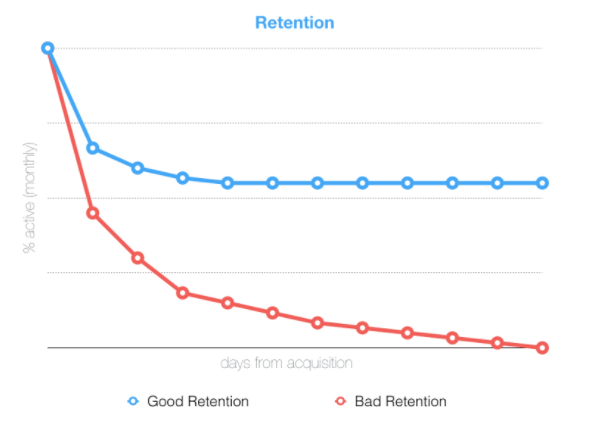

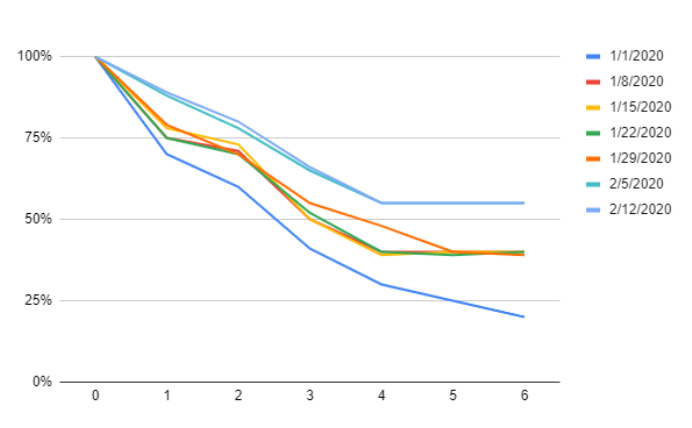

- Churn/ retention Rate

The Revenue/Retention Curve

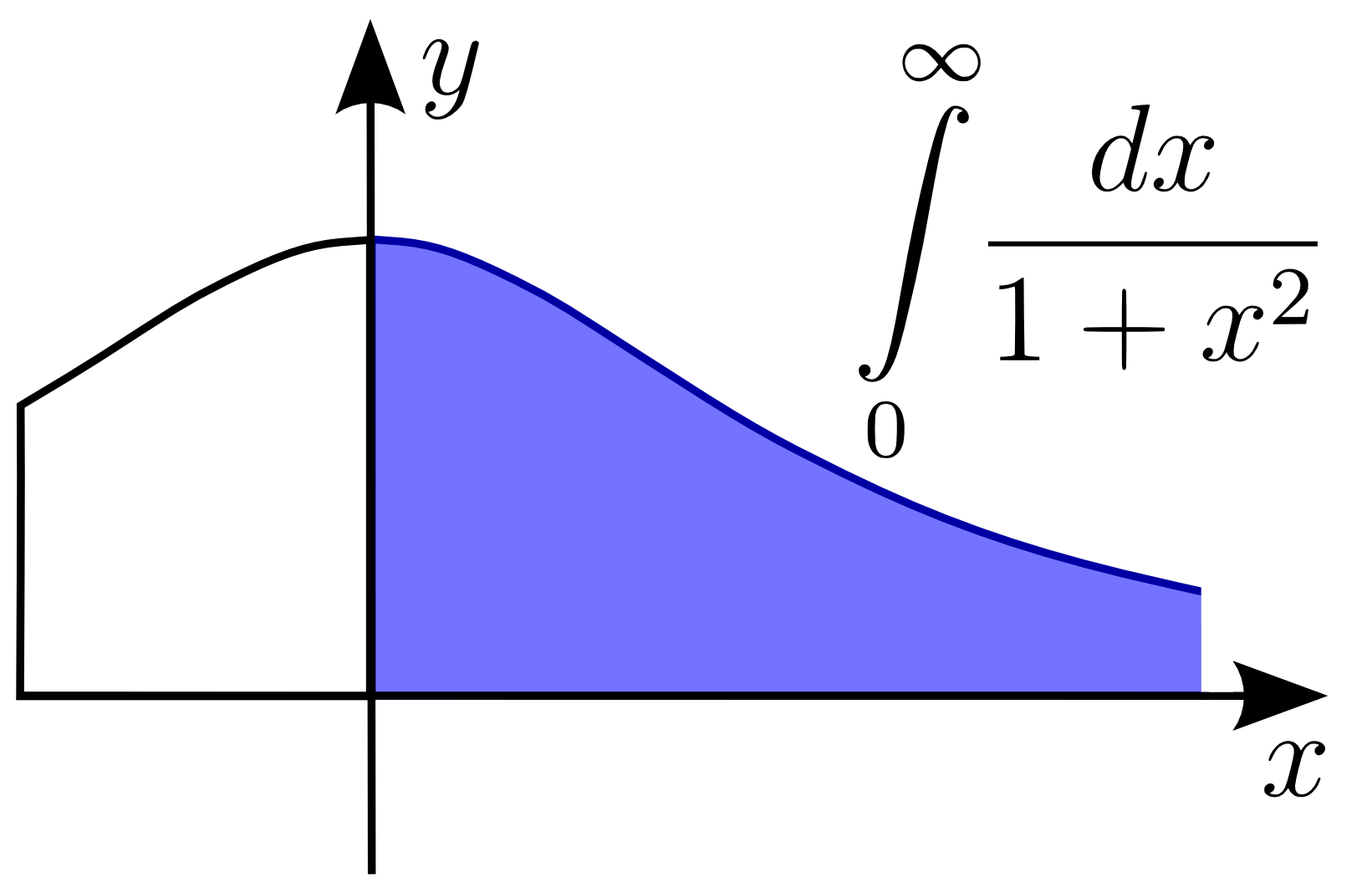

Having worked as a retention analyst for McCaw Cellular / AT&T Wireless I was introduced to an important concept – “Area Under the Curve Equals Lifetime Revenue”. More about this later.

Cohorts

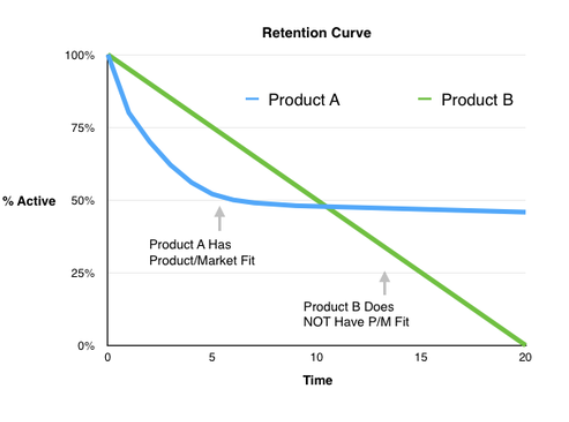

Determining the shape and slope of the curve is a huge determinant of company value and performance. In fact, much of my time was spent looking at cohorts. Typically these were a group of customers that came on during a certain month or shared a certain demographic.

The Hurdles

In any start-up there are a number of key hurdles including:

- Will customers try what I have to offer? ( Free Trial)

- Will they buy it..and at what price? ( Subscribe)

- Will they continue using and paying for it? (Retention )

Product / Market Fit

Having the right offering for the target market is key.

Case Study – Carepacity

$30 million worth of value created in 3 years at just one hospital location! My client Carepacity offers an outstanding example of enhancing operations and creating value in a niched market (emergency medicine).The company is used by emergency departments to manage patient flow and demand capacity. The system is able to reduce patient lobby wait times from over an hour to less than five minutes.

Key benefits include:

- Reducing left without being seems ( LWBS),

- Increasing Hospital admissions;

- Reducing patient length of stays ( LOS);

- Increasing Visits to the emergency department;

- Reducing Physician Turnover;

In other words… increasing revenue and reducing expenses.

Creating Versus Capturing Value

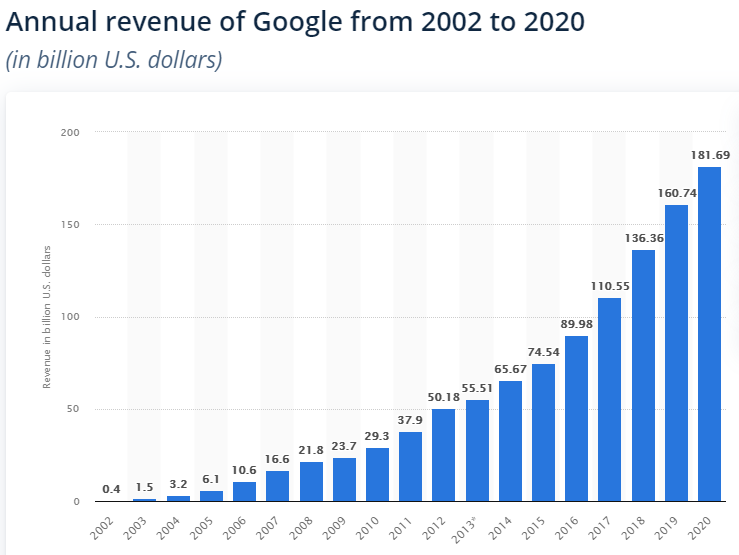

As billionaire Peter Thiel points out…”value creation and value capture are two different things”. In a recent year, the airline industry made 4% or profit on $472 billion in sales. On the other hand, Google had a net income of $40 Billion on $182 billion in gross revenue. In other words, Google made over twice the amount of the entire airline industry.

Google is amazing at capturing value because it is a near monopoly with about 90% of the search business. On the other hand, airlines are highly competitive and bid down each other prices and profit margins.

How to Value a Subscriber Business

There are several metrics needed to value a subscriber business including:

- Monthly subscription Revenue

- Monthly Subscriber churn rate

- Subscriber Add and or Revenue Growth rate

- Net profit Margin

Remembering Calculus and doing a Happy Dance!

Remember Calculus, the integral and the idea of finding an area under a curve? It turns out that if you divide the monthly revenue (or net income) by the monthly churn percentage, you can easily calculate the area under the curve. True confessions…I struggled through High School Calculus and did a little happy dance when I initially had this insight.

Example: You have a subscriber base providing $5000 in monthly revenue. The monthly revenue churn rate is 1% . This means that the base loses 1% of its revenue every month. The projected future revenue stream is $5000 /.01% or $5000 x 100 or $500,000!

The fact that a $5000 per month revenue stream can be worth half a million dollars or $500,000 is a bit incredible to me. The human mind is not very good at calculating things like compounded interest. I remember when my father asked my nephew to calculate the grains of sand needed if you put one grain on the first square of a chess board then doubled it on the second square. By the 64th square you would need more grains of sand than exist on all the beaches of this planet.

What about time value of money?

Now those in finance might ask .. “what about time value of money”…and they would be right. The revenue stream should be adjusted by prevailing interest rates. My shortcut is to take 70% of the prior number. So $400,000 x 70% is about $280,000. But for you geeks out there Excel offers a nice annuity function which allows

What about risk and uncertainty?

If I’ve learned anything from being in a pandemic is that life is uncertain. But you have to distinguish between macroeconomic and microeconomic risks. Macroeconomic risks are things like stock market and real estate crashes.

Microeconomic risks are fundamentals in business models. I like what Warren Buffet says about macro risks… “ I can’t predict or control them so I don’t worry about them as much. I see microeconomic risk more as uncertainty. Good tracking systems allow us to determine and fine tune key metrics. And remember that there are only half a dozen of these that really matter.

I believe that reducing business model uncertainty is one of the most important things a new venture can do. And that comes from zeroing in and understanding baseline assumptions. This is where LEAN Start-up philosophy comes to play. Eric Ries recommends testing key assumptions with a ‘Build-Measure-Learn” technique.

I believe that many entrepreneurs don’t really want to know. As Jack Nicholson might say.. “You can’t handle the Truth”. Getting emotionally honest with oneself is critical.

How about taxes? A tale of two incomes

In some ways I like an income stream better than windfall because it is usually taxed at a lower rate. It allows you to spread out tax liability over time.

John makes $5000 per month as an employee. In other words he receives compensation for his services roughly equal to $30 per hour. Should John quit or find himself unable to work he loses any future value. The same is true for those self-employed.

On the other hand, Bill had built a $5000 per month subscription business. Let’s assume he spends a few hours a month maintaining the business. As mentioned earlier he has built an asset worth up to half a million dollars.

Both income streams are taxed at the same rate but they are very different. John is essentially an income “renter” while Bill is an “owner”. If John is unable to work, he no longer receives his income. Bill continues to receive income.

Conventional financial wisdom is to save money during your career and place it into investments. And this is a solid strategy if you start early enough in your career and save consistently. A conservative financial advisor might recommend living off of the interest alone. So one might ask the question “how much money do I need in the bank to generate $5000 per month in interest payments?

In banking there is something called APY or annual percentage yield. Currently banks are paying 0.5% on high yield accounts. Please note that is not 5% but ½ %. If you put $100 into savings the expected return would be $0.50 after one year. That means that you would need $12 million in “safe investments” in the bank to generate $60,000 in annual recurring revenue.

On average, as measured by the S&P 500, the stock market has returned roughly 10% per year. This can vary widely each year depending on a variety of market factors. In the last 20 years, the market had shown annual returns between – 37% in 2008 and +31.49% in 2019. Assuming a 10% return, you would need $600,000 in investments to create an fluxing $60,000. And you had better hope we don’t have another bad year like we did in 2008.

What about Inflation?

The U.S. consumer price inflation rate hit a 13-year high in June 2021, reaching 5.4 percent. The rate remained the same in July 2021, indicating an increase in prices of 5.4 percent compared to last year. The cost of food, both at home and away from home, inclined, along with new vehicles and living spaces. My way of looking at this is that unless your assets (home equity or stock portfolio) are appreciating more than 5.4% per year…you are treading water or losing money.

Efficient Markets

My belief is that most markets…including real estate and the stock market are fairly efficient. So is making money in these markets “dumb luck” or a matter of timing? In many cases it might be. i believe that most investors are unconscious. They make investments based upon stock tips. Most do not have the skill set or financial literacy to adequately evaluate opportunities. Thus some will win and some will lose,

Warren Buffet and Charlie Munger of Berkshire Hathaway choose not to invest in real estate. They don’t believe that they can offer a value perspective there or have a distinctive competence. On the other hand, they spend countless hours sorting through businesses to become Berkshire Hathaway portfolio members. Berkshire never replaces or rebrands or interferes with acquisition companies. But they do offer their member companies huge liquidity and association benefits.

Special “Under the Radar” Situations

I believe that some of the very best opportunities are not available to the average investor but to insiders. These are people who have access to equity before a company becomes a success. It is well known that many of the initial employees and shareholders at Silicon Valley start-ups have been able to build wealth via founder’s stock and employee stock options.

BrandMother – The Ultimate Insider

Brandmother works with companies mostly at the beginning of their lifecycles. And doing so has given us a perspective on the types of businesses that are likely to succeed. We invest our time and energy in situations such as Carepacity that we believe offer tremendous value to their clients. We ask the value question first and then work backwards to understand how we capitalize on that value.

We favor subscription / membership internet based services. We are able to add immediate value via:

- The Idea

- Brand (Name and Logo)

- Business Plan

- Business Model – including key metrics

- Intellectual properties (concepts and designs)

- Team Development

- Fundraising and capital formation

We are looking for three types of partners:

- Member / Business Development

- Value Delivery Partners

- Financial/ Capital Investors

Membership Builder Partners

We are offering Alliance or Membership builder opportunities to a select group of partners. In return for helping to bring on new clients they might receive up to 40% of the Gross Revenue. Why so generous? Because it works! I did a study of the most successful SaaS companies and most seem to follow a 40/20/20 plan. 40% to Sales and Marketing, 20% to R&D and Value Delivery and 20% to administration. Please note that the 40% includes all sales and marketing expenses.

Value Delivery Partners

Value delivery partners offer expertise in software development, search engine optimization, design and onboarding. This is an opportunity for creators to be part of a team yet maintain their independence.

Financial Investors

We are looking for a limited number of qualified investors to provide seed capital where needed. Investors generally as three questions:

- How much do you need?

- How do you plan to use it?

- How will I get my money back?

Most VC backed start-ups are trying to raise big money and have big exits. Years ago I met with a VC at Draper Fisher Jurvetson (DFJ) and he said.. “ We love your idea but don’t think the $100 million plus exit is not there”. Today I feel I can offer an investor something much more which is a healthy return on their capital without an exit. Investments can be structured to receive say 10% of net revenue starting as early as one year out.

I believe that these “special situations” can be both fun and rewarding. We don’t recommend you put a large part of your portfolio in this or bet the “lunch money”. When Jeff Bezos first raised capital for Amazon he told is friends and family to be prepared to lose it all.

But the thing I like most about BrandMother ventures is that they have very low burn rates and profit thresholds. We don’t hire expensive staff of have full time employee teams. I follow Trevor G. Blake who has built and sold three $100 million plus companies with virtual teams.

This is the starting valuation of the company. As a formula it is the (investment /percentage of company). As an example if the investment amount is $50,000 and the percent of the company is 10% then the valuation is $500,000.

Pre-money valuations are a bit arbitrary because a start-up does not have a track record or benchmark metrics figured out. But our goal is to triple an investor’s value contribution in three years.

Recent Comments